| | | Martin's Weekly Briefing: For more tips, alerts & puns, follow Martin on Twitter - Now 26 mths 0% spending/borrowing credit card: longest ever

- 20mths 0% NO FEE balance transfer: longest ever no fee

- Personal loans are in on it too, down to 3.4% APR: lowest rate ever

The credit crunch is well and truly dead and buried. We've now had 79 months in a row of 0.5% UK interest rates & with the global economy still gloomy, providers are pricing long-term debt cheaper than ever before. The credit crunch is well and truly dead and buried. We've now had 79 months in a row of 0.5% UK interest rates & with the global economy still gloomy, providers are pricing long-term debt cheaper than ever before.

So if you need to borrow or cut the cost of existing borrowing, this is a great time. Yet the one fly in the ointment is while deals are better than pre-crunch times, they're harder to get. So here are my key 12 need-to-knows...

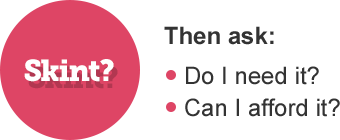

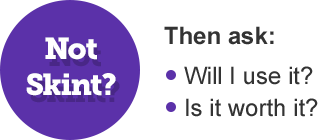

| 1. | Is it worth borrowing? Unless you're a super savvy stoozer, only do it if you really must. If you already have debt, do try to cut its cost.

- Just funding your ongoing lifestyle? This is the worst type of borrowing as it means you're living beyond your means and risk a debt spiral. Avoid it. Use the Free Budget Planner, stop spending and cut your cloth accordingly.

- For a needed, planned purchase. (Eg, a car for a new job, or annual car insurance as it's cheaper than monthly.) Minimise the amount & repay quickly to keep interest low & only do if repayments are affordable. | | | | 2. | Will you get accepted for top deals? It depends on your credit score. The only way to find out is to apply, but that leaves a footprint on your credit file. Too many, especially in a short time, hurt future applications. Use our free credit card eligibility calcs and loans eligibility calc to see your odds of getting a card or loan pre-applying. If you're struggling to get accepted, see my 36 tips to boost your credit score. | | | | 3. | The cheapest way to borrow is a 26mth 0% spending credit card. With no interest and no fee, this is without doubt the cheapest way to borrow, if: a) you can pay what you need on plastic; b) you can clear the debt in the 0% time; and c) you follow the golden rules below.

The Clydesdale*/Yorkshire* 26mth 0% spending card is the longest ever. It's followed by Post Office's* 25mth 0% (provided you spend on it within the first 3mths). Try the 0% spending eligibility calc, and ensure you follow the golden rules...

1) Repay/shift debt before 0%s end or they jump to 18.9% rep APR.

2) Pay at least the monthly min, or you lose special rates.

3) Don't withdraw cash - it's not at 0% and can harm your credit score.

Full help & options in the Top 0% Cards guide. (APR Examples.) | | | | 4. | The cheapest loan is now 3.4%. If you want to borrow more, borrow longer, or want the discipline of fixed monthly repayments, then personal loans win. Use the Loans Eligibility Calc to find which you've best odds of getting.

For £7,500 to £15,000 loans Sainsbury's* is 3.4% rep APR over 1-3yrs for Nectar card holders (if not, get one free first) and over 4-5 yrs* 3.5% rep APR. M&S* is 3.5% rep APR over 1-5yrs. For less, two lenders dominate.

- £5,000-£7,499: Zopa* 4.3%-4.4% rep APR, Hitachi* 4.4% rep APR

- £3,000-£4,999: Zopa* 4.6%-6.9% rep APR, Hitachi* 7.4% rep APR

- £2,500-£2,999: Zopa* 6.9%-7.4% rep APR, Hitachi* 7.4% rep APR

- £2,000-£2,499: Zopa* 6.9%-7.9% rep APR, Hitachi* 12.3% rep APR

- £1,000-£1,999: Zopa* 7.7%-7.9% rep APR, Hitachi* 12.3% rep APR

It can also be worth checking Ratesetter* too which like Zopa gives a range. Full options: Cheap Personal Loans (APR examples) | | | | 5. | Nationwide customer? You can get loans, as low as 2.9%. If you've got a Nationwide current account (or switch to one) and are accepted for a loan from any bank or building society (incl Hitachi but not peer-to-peer lenders Zopa/Ratesetter), take proof to Nationwide and it'll beat it by 0.5 percentage points if you also meet its criteria. So 3.4% becomes 2.9%. Full Nationwide loan trick info. | | | | 6. | 24mth 0% loans for smaller amounts (for a fee) from a credit card. If you need cash (eg, to pay off an overdraft) or to buy something you can't put directly on a card, the winner's a 0% money transfer credit card. These rare cards pay cash into your bank, and you owe them.

New MBNA 'up to' 24mth 0%* cardholders (eligibility calc) get it for a one-off 1.89% fee (roughly £19 per £1,000 - far cheaper than loans). For longer, this MBNA 'up to' 36mth 0%* (eligibility calc) has a higher 2.99% fee.

Very few others offer this, so only do it if you're sure. Never miss a monthly repayment & clear before the 0% ends or they jump to 22.9% rep APR. Full help in 0% credit card loans (APR Examples). | | | | 7. | Shift existing credit card debts to 20mths 0% NO FEE or 37mths 0% (2.69% fee). If you need to cut credit card debt costs, use a balance transfer deal. This is where you get a new credit card that repays these debts for you, but at a cheaper rate. Choose the lowest fee, provided you're sure you can repay in that time...

- Halifax* 'up to' 20mths 0% NO FEE (18.9% rep APR after).

- Post Office* 'up to' 26mths 0%, one-off 0.4% fee (18.9% rep APR).

- Barclaycard* 'up to' 37mths 0%, 2.69% fee (18.9% rep APR).

- Halifax* 'up to' 37mths 0%, 2.75% fee, for transfers of £1,500+ it beats Barclaycard as it gives £35 cashback (18.9% rep APR).

Follow the golden rules - help in Balance Transfers (APR Examples):

a) Use the eligibility calc to find your best acceptance chances.

b) Repay at least the set monthly min, or you can lose 0% rates.

c) Clear the card or shift again before the 0% ends, or rates jump.

d) Don't spend/withdraw cash. It's not usually at the cheap rate. | | | | 8. | Beware 'representative APR' - it means 3.4% can be 20%. You'll see all cards & loans have a 'rep APR' or 'representative APR'. This means only 51% of those accepted need to get the rate lenders quote or advertise. The rest can be charged anything, there's no limit.

It's very hard to crack this. Our loans eligibility calc and cards eligibility calcs can't do it, but as a very loose pointer, the higher the acceptance chances the better hope you have of getting the rate. | | | | 9. | Beware the 'up to' 0% too. If we add the words 'up to' to a 0% offer, it means only 51% of those accepted may get that length. Unlike 'rep APR' this isn't a regulated term, it's our term, sometimes we only find out by the small print. So if all things are equal (including credit card eligibility calc score) - go for the card that isn't an 'up to' to be sure. | | | | 10. | 'I've got a score of 60% with the eligibility calc - is it worth applying?' I'm often asked this. Actually 60% is still pretty decent as odds go - in other words, more than half the people in your position get accepted, not bad at all.

All you risk by applying is a footprint on your credit file - that'd only have a minor effect (it's multiple applications that hurt). So consider how important the deal is, eg, if to cut debt costs it's significant. | | | | 11. | Struggling? Are you eligible for a Government 0% loan? If you're looking at horrid debt such as payday loans, try these instead. There's no credit check, but they will check you can repay. Local council support schemes are for those in emergencies with no savings; budgeting loans for those on some benefits to help meet essential living costs.

| | | | 12. | Credit unions can give loans to those who'd pay high rates elsewhere. Credit unions are small savings and loan co-operatives for communities. They usually lend from £1,000 to £10,000 - APRs are typically about 13% but can be higher (though they're capped at 42.6% APR). Find your credit union. | | |

Worried about your debts? Debt is like fire, it's a useful tool, but get it wrong and it burns. If you can't meet minimum repayments or aren't sleeping due to worry, read my Debt Crisis Help guide or get one-on-one non profit help from Citizens Advice, StepChange, National Debtline or, for emotional help too, CAP.

They're there to help, not judge, many people's first comment to me after is "I finally slept last night." Read some inspiring stories in our Debt-Free Wannabe forum and also my Mental Health & Debt guide. | | | | | | | | | | | | | | | | | | It's the EVERYTHING AT ONCE bank switch, taking the hot offerings of its competitors and combining them

To seduce you to switch, top bank accounts have developed many bribes - hard cash upfront, high in-credit interest, monthly cashback or hot linked savings accounts. This is the first time one bank's given all. Here's how it compares. -

New. Free £125, £5 cashback, 5% interest & 5% linked savings. Until 2 Nov, via this link, TSB* gives accepted switchers a free £125 on its recently launched '555' deal (go direct you get nowt). The '555' is 5% cashback on the first £100 of debit card contactless spending a month (till Dec 2016) - so a free monthly £5 for many. Plus 5% AER interest on balances up to £2,000, and get access to a 5% linked regular savings account. New. Free £125, £5 cashback, 5% interest & 5% linked savings. Until 2 Nov, via this link, TSB* gives accepted switchers a free £125 on its recently launched '555' deal (go direct you get nowt). The '555' is 5% cashback on the first £100 of debit card contactless spending a month (till Dec 2016) - so a free monthly £5 for many. Plus 5% AER interest on balances up to £2,000, and get access to a 5% linked regular savings account.

-

Free £150, 6% linked savings & top service. While you can earn more with TSB, First Direct* has won every customer service poll we've ever done (92% rate it 'great'), and via this link, switchers currently get £150 (usually £125). It also has a £250 0% overdraft and gives access to its 6% regular saver account. -

Ending. Free £125 plus £5/mth. Until Sun Halifax* pays Reward Acc switchers a free £125 (usually £100), and if you stay in credit, a fixed monthly £5 'interest'. This beats TSB if you've small savings & won't use contactless. -

For bigger savers: 3% interest on £20,000 & cashback on bills. Santander 123* has good service ratings, pays 3% AER on £3k-£20k, plus up to 3% cashback on bills incl b'band, council tax & energy. The cashback oft wipes out its £2/mth fee, though that's rising to £5/mth in Jan. See Martin's Is Santander 123 a winner after fee hike? -

Do you earn enough to get 'em? All top deals, except the one from M&S, set a 'min monthly deposit' to ensure your income's paid in. TSB & Santander are £500/mth (equiv to a £6k salary), Halifax £750/mth (equiv £9,150), First Direct £1k/mth (equiv £13,200) - though there is a workaround. You also usually need to use their switching service & have two direct debits, to qualify for above perks. See Top Bank Accounts for full eligibility criteria. | | | | | 100 supermarket coupons you can print worth £80+. We've updated our page to list over 100 coupons, eg, £3 off cat food, £1 off Fairy non-bio. See 100 supermarket coupons. Related: How to be an extreme couponer.

35,000 FREE £14-16 Ideal Home Show at Christmas tickets (London & Manchester). We've managed to bag 19,000 for London (25-29 Nov) and 16,000 for Manchester (12-15 Nov) for you. Free Ideal Home tickets

Get a YEAR's Tube overcharges back - 'I got £72 in 10 mins'. Check now. New TfL Refunds guide.

Cheap wills: book a Will Aid appointment NOW. Nov's Will Aid month, letting anyone of any age get a solicitor-drafted will for a suggested £95 charity donation (cheaper than most solicitors). Places go fast. Full Will Aid info.

Ends Fri: Feel Unique £10 off £25 beauty products code, eg, YSL, Benefit etc. MSE Blagged. Feel Unique sells branded beauty products online, this code gets £10 off (while stock lasts), eg, Touche Eclat £15. Feel Unique | | | | | | | | | | | Snoop on what your neighbours paid, investigate price cuts, crime hotspots, flood risks, local schools & more

House values aren't only important if you want to sell. If yours has increased, it may let you switch mortgage to a cheaper deal by improving your 'loan-to-value' ratio (ie, your borrowing's a smaller proportion of your home's current value). We've updated our Free House Valuations guide with secret web weapons to interrogate any property... on the house. A taster... -

Free 'valuations'. Some sites offer free online valuations, though take 'em with a pinch of salt, as they're auto-generated. It's best to estimate yourself, finding what any property last sold for and checking local prices. Plus an ingenious web browser add-on shows sellers who've altered listings, incl price cuts. See price histories. Free 'valuations'. Some sites offer free online valuations, though take 'em with a pinch of salt, as they're auto-generated. It's best to estimate yourself, finding what any property last sold for and checking local prices. Plus an ingenious web browser add-on shows sellers who've altered listings, incl price cuts. See price histories.

-

Check for schools, floods, noise, crime and more. For looking at new properties, a school checker tool maps rough catchment areas and quality, a police crime-mapping site shows recorded street crime levels, plus a 10-sec search could save years of hassle by analysing flooding and subsidence risks. There's even a road traffic noise check. -

Can you get a cheaper mortgage with a higher home value? With mortgages still very cheap, and discussion of rate rises next year, it's a good time to check. Our Mortgage Best Buys Comparison Tool shows all deals available, and incorporates fees into the costs. Plus ensure you know what you're doing with our free 40+ page printed booklets: the Remortgage Guide 2015, First-Time Buyers' Guide 2015 & Buy-to-Let Mortgage Guide. | | | | | Warning: Bank with Barclays? If you pay extra for insurance, eg, its Additions acc, is it switched on? Don't assume the fact you pay for mobile, gadget or even travel cover means it's live. Activate Barclays insurance

£10 off £30 Amazon trick (if you live in West Mids or within M25). Full info see our Amazon £10 off trick blog.

Is the new state pension top-up worth it? On Mon a new Govt scheme launched - giving millions the ability to pay to get a bigger state pension. Read Martin's 3-min briefing or our full step-by step State Pension Top-ups guide.

New. Cheapest energy tariff - save £290/yr and FREE case of wine. uSwitch's 12mth E.on fix (£30/fuel exit fee) is cheapest for most. For typical bills it's £803/yr compared to an avg £1,095/yr for a big 6 standard tariff. Compare & Free Wine: To get it, do a uSwitch* dual fuel comparison via this, our link (not direct), switch via it and after 4mths it'll give you a code for 6 free Naked Wine bottles (be Drinkaware). See Cheap Gas & Elec. Warning: Unlike our Cheap Energy Club, with uSwitch comparisons you must select its 'show me the whole market' option, or it only shows deals that pay it.

£10 specs code (incl lenses) or £30 designer, eg, Ted Baker. MSE Blagged. Sight for sore eyes. Glasses deals | | | | | They can get this email free every week | | | | | | | | | 14 things first-time buyers need to know. From help to Buy ISAs to getting a mortgage. 14 first-timers' tips

Molton Brown £15 off £30 vch/code in £4 mag. Huge this time last year. Great for Xmas smellies. Molton Brown

Half-term activity week for 16-17-year-olds £50 (free for some). This Govt-backed Eng and NI scheme includes 3 nights away & gets 'em abseiling, canoeing & learning life skills during Oct half-term. National Citizen Service

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"Took Martin's advice 7 years ago and started overpaying my mortgage - saved £18,600 and paid up early by 8 years and 3 months." See our Should I overpay my mortgage? guide and Overpayment Calc.

'Free' 3.5L Coca-Cola via cashback. Buy 2 btls for £1.85 (via 2for1), then upload receipt via app. Free Coke trick | | | | | It's university application season. Many are wrongly scared due to "£50,000 debt" headlines, here's the truth...

Tomorrow's the main application deadline for medical/vet students and Oxbridge, most other courses are 15 Jan. So if you're worried about how you'll pay, read Martin's fully updated 20+ Student Loan Mythbusters with everything you need to know about student finance in ENGLAND for this year and 2016-17 starters. Here's an intro course, to get you started... -

You don't need cash to pay for uni. First-time UK undergraduate tuition fees are paid by the Student Loans Company, you only repay if you earn enough after uni. If you're considering avoiding a loan, read Martin's beware paying uni fees upfront. You don't need cash to pay for uni. First-time UK undergraduate tuition fees are paid by the Student Loans Company, you only repay if you earn enough after uni. If you're considering avoiding a loan, read Martin's beware paying uni fees upfront.

-

You repay 9% of everything earnt over £21,000/yr. Earn less and you repay nowt. You stop repaying after 30 years unless you clear what you owe plus interest first. As what you repay depends on earnings financially it's a NO-WIN, NO-FEE education. Bizarrely many worry how they'll repay if they don't earn enough - you don't have to. It's big earners who'll repay lots. The student loan repayment calc estimates your real cost. -

You get loans for living, but they're not generous. Headlines screech "£50,000 uni debts", yet the biggest problem we hear from students is loans aren't big enough; as the 'maintenance loan' for living costs isn't enough. New 2016 starters will get bigger loans, but no grants (see Martin's why grants ending won't cost most more analysis). Living loans are means tested based on parental income (unless you're financially independent) and parents are expected to meet the shortfall, though there's no way to force them. See how big is my living loan? -

It's different in Scotland, Wales & NI. The above applies to 2016-17 students from England. Scottish, Welsh & N Irish students can pay less (or nothing) in tuition fees, depending where they study. See UK tuition fees.

PS: Join our campaign to stop the Govt student loan U-turn. It's proposing retrospectively hiking costs - meaning many could pay more. Read Martin's Student loan U-turn blog which includes a template to write to your MP. | | | | | 2,000 free £8 Northern Homebuilding & Renovating Show Tix. Harrogate 6-8 Nov. Homebuild show

Heads up: Tesco Xmas Clubcard double-up starts 2 Nov. Hold on to points for now. Tesco pts

FLASH currency sale on euros, dollars & more. Asda's boosting rates till 8am Fri. Use our Travel Money Comparison to see how it stacks up. Not going yet? The Halifax Clarity* credit card (eligibility calc) gives near-perfect spending rates worldwide, beating exchange bureaux. But pay off IN FULL each month, or it's 18.9% rep APR. See Cheap Overseas Cards (APR Examples).

Direct Travel closes for new business. Though it's still valid if you've got it. See Direct Travel info. | | | | | | Who's the complainer in your home? Having just been on a roadshow for his TV show, Martin noted that when heterosexual couples were asked to complain, whether about faulty broadband or bad food at a restaurant, the men usually did the complaining. Please vote who's the complainer in your house?

Last week: 8,730 voted on what they thought of shops selling clothes made using child labour. Surprisingly, 57% said they'd still consider buying from these shops while only 43% said they'd never shop there again. However, when we last ran this poll in 2013, a huge 80% said they'd still buy from these shops. See the full 2015 results. | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 15 Oct - Good Morning Britain, ITV, Deals of the Week, 7.40am

Fri 16 Oct - This Morning, ITV, Martin's Quick Deals, from 10.30am. Watch previous

Mon 19 Oct - This Morning, ITV, Money Monday, from 10.30am. Watch previous

Mon 19 Oct - BBC Radio 5 Live, Lunch Money Martin, 12pm-1pm. Subscribe to podcast

Thu 15 Oct - Wed 21 - Dictionary Corner, Countdown, 2.10pm. | | | | Thu 15 Oct - Share Radio, 11am | | | | | | | Q: The MOT on my car has expired, but it's booked in at the end of the week for a test. Is it still insured for me to drive? Sam, by email MSE Tony's A: If you're only driving to the test centre, you are insured to drive. But if doing ANY other driving, without a valid MOT, you're breaking the law and risk a £1,000 fine and a conviction. You also risk invalidating your insurance so you may have to pay for any damage to your vehicle or another one if you have an accident, and risk a separate conviction for driving without insurance. For more information on MOTs, and finding a local test centre, see our Cheap MOT Tricks guide. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go, check out this video 'if everyone worked like energy firms', a two-minute hidden camera film where supermarket shoppers are told their "bills are estimated". We hope you save some money,

Martin & the MSE team | | | | | | |

No comments:

Post a Comment