| | | Martin's Weekly Briefing: For more tips, alerts & puns, follow Martin on Twitter Bank a b*****d? Stop bitching, start switching - Last chance: free £150, top service, 0% overdraft & 6% linked savings

- Or up to 3% interest on your savings, plus cashback on your bills

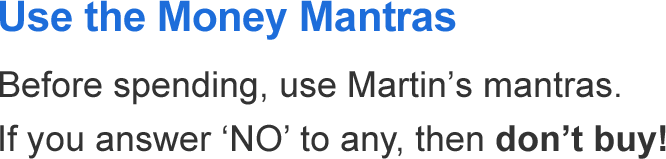

Collectively, banks are rarely mentioned in glowing terms, yet some individual banks do crest above that wave, so every six months we poll your experiences to split the champs from the chumps. And with a bank price war on right now, if your bank isn't treating you royally, don't bitch: just switch to the top banking deals. But get your skates on - many hot deals are ending. Here are the need-to-knows: | 1. | First, how does your bank rank? Of course, you know whether it's been good or bad to you but this shows the wider picture, and is a good indication of whether it would help if you needed it. Plus it lets you see how our top switch picks below fare too.

The winner, as always, is First Direct*. It's topped the poll results every time since we started doing this way back in 2010... | | | | | | Top Banks For Service (over the last six months)

Poll closed 23/2/16, 8,600 voters. 1. First Direct: Great: 91%; Poor: 3%

2. Nationwide: Great: 77%; Poor: 4%

3. Santander: Great: 72%; Poor: 6%

4. Co-op Bank (incl Smile): Great: 70%; Poor: 7%

5. TSB: Great: 69%; Poor: 7%

6. Halifax: Great: 60%; Poor: 10%

7. Lloyds: Great: 53%; Poor: 12%

8. NatWest: Great: 50%; Poor: 14%

9. Clydesdale & Yorkshire: Great: 49%; Poor: 18%

10. Bank of Scotland: Great: 49%; Poor: 19%

11. HSBC: Great: 43%; Poor: 19%

12. RBS: Great: 44%; Poor: 22%

13. Barclays: Great: 42%; Poor: 20%

Ranked via 2 pts for great, 1 for OK, 0 for poor. Excludes banks with sub-100 votes. See full results. | | | | | 2. | Seven-day switching means it's mostly no hassle. Two years ago 7-day switching was introduced, it's been a game changer. Within 7 working days, your new bank: a) Switches direct debits and standing orders for you, and b) Closes your old account & ensures all payments to it go to the new one.

I twitter-polled 1,300 people yesterday, 81% had found it mostly easy & hassle free, 9% said it was awful. Responses included @jjaron's "Utterly painless, more people should do it" and @Katy_aka_bob's "it was simplepimples". | | | | 3. | ENDS MON. Free £150 for switching to number 1 bank. The fight for switchers means many banks now pay you, tax-free, to do it. Better still, most that do are high up the customer service tables too.

To qualify you'll usually need to use their switching services, meet their 'min monthly pay-in' (their way of getting you to pay your income in), pass a not-too-harsh credit check and have 2+ direct debits set up. Full rundown in Best Bank Accounts, here's the headlines:

- Ends Mon: Free £150 + No.1 service + 0% overdraft + 6% linked savings: Until 11.59pm Mon, via this link, First Direct* pays a £150 bonus (£100 after). It also has a £250 0% overdraft and linked 6% regular savings. Min pay-in: £1,000/mth (£10/mth fee if not).

- Free £150: Clydesdale* / Yorkshire's* Current Account Direct pays switchers £150 and gives 2% AER on up to £3k. Min pay-in: £1k/mth.

- Free £125 + £5/mth: Until 22 Mar Halifax Reward* gives switchers £125 (£100 after), plus £5/mth if you stay in credit. Min pay-in: £750/mth.

- Free £100 M&S gift card + £10/mth: Switch to M&S Bank* and get a £100 M&S gift card, £100 0% overdraft and 6% linked regular savings. Pay in £1,000/mth & for the first year it adds £10/mth to the gift card.

- Ends Sun: Free £100 + up to £5.50/mth: Until 11.59pm Sun, Co-op* pays switchers £100 (nowt after), plus sign up to its Everyday Rewards scheme and jump through a few hoops to get up to £5.50/mth. | | | | 4. |  Free £100 for switching and you NEEDN'T pay in money each month. Many with low or uncertain incomes worry about banks' 'minimum pay-in' terms. While there is a way to jemmy it, I get that this isn't for everyone. Free £100 for switching and you NEEDN'T pay in money each month. Many with low or uncertain incomes worry about banks' 'minimum pay-in' terms. While there is a way to jemmy it, I get that this isn't for everyone.

Yet M&S Bank* gives switchers a £100 M&S gift card, a £100 0% overdraft & linked 6% savings, and there's no min pay-in needed (though it does currently have a first year incentive that in every month you do pay in £1,000+ it'll add £10 on the gift card). | | | | 5. | Top for savings interest: TAX-FREE 3% on £20k or 5% on £2k. The alternative way to suck in customers, rather than cash bribes, is to pay loss-leading interest rates for those in credit.

And, from 6 April all basic-rate taxpayers will be able to earn £1,000 annual interest tax-free (higher rate £500) due to the new Personal Savings Allowance, making these tax-free for most.

- 3% interest + up to 3% cashback: For bigger savers Santander 123* smashes any other form of savings, paying 3% AER variable interest if you've £3,000 to £20,000 in it. Couples can open one each and a joint one, so that's a max £60,000 between two.

You need to pay in £500+/mth and there is a £5/mth fee but for most that's covered by the cashback it pays on direct debits: 3% on mobile, phone & b'band; 2% energy; 1% water, council tax & Santander mortgage payments (see my Is Santander 123 worth it? blog). As Fi B tweeted: "Opened 2yrs ago, cashback total = £645.69. Happy days." Alternatively...

- Earn 4% on £4,000-£5,000: Club Lloyds* pays 4% AER variable plus has a linked 4% regular savings account to put up to £400/mth in too (min pay-in £1,500/mth, else £5/mth fee).

- Earn 5% on up to £2,000: TSB* pays 5% AER variable, plus up to £5/mth cashback on contactless spending & a linked 5% regular saver (min pay-in £500/mth).

- Get £5 each month you stay in credit (+£125): Halifax Reward* pays this regardless of how much you have (min pay-in £750/mth).

| | | | 6. | Can you open lots of bank accounts to save more at high interest? It's tricky, but doable. Many MoneySavers armed with spreadsheets find it very lucrative. For a full how-to, see 5% Savings Loophole. | | | | 7. | Cut overdraft charges to 0%. An overdraft's a debt like any other, so if you often go into the red, cutting its cost makes it easier to clear. Like any other debt though you will be credit scored when switching.

- Under £400 overdraft? Switch to 0%. First Direct* has a £250 0% overdraft, but also currently gives £150 to switchers, so that'd instantly clear some. So providing you can meet its min £1,000/mth pay-in, nothing beats it.

Nationwide's FlexDirect* may give a bigger 0% overdraft, though the amount is credit-score-dependent, but only for a year (50p/day after, so aim to clear before). Full info in top 0% overdraft bank accounts.

- Shift it to a 0% credit card. A few rare cards let newbies do 0% 'money transfers', where they pay cash into your account to clear overdrafts, so you owe the card instead. Virgin Money's* 36mths 0% for a 2.39% fee (min £3), or if you can repay quicker, another is Virgin Money's* 32mths 0% for just a 1.69% fee (min £3). Yet always...

(i) Use our Eligibility Calc to see which card's most likely to accept you.

(ii) Ask for a 'money transfer' to do this; don't just withdraw cash.

(iii) Never miss a min monthly repayment or you can lose the 0% deal.

(iv) Repay before the 0% ends or rates jump to 20.9% rep APR.

This can be tricky, so if unsure, read our full help in Money Transfers. | | | | 8. | Free travel insurance - great for older travellers. The Nationwide FlexAccount* is fee-free and includes European travel insurance for the account holder(s) up to age 74 - and indeed that's when this really looks a good deal as travel cover is expensive as you get older.

Full eligibility info and more options in Best Bank Accounts, or see Cheap Travel Insurance to compare. As with all travel policies, always disclose pre-existing conditions. | | | | 9. | Is it worth paying a monthly fee for a packaged bank account? Many are wasting big money paying for packaged bank account insurance extras (like travel or mobile cover) that they don't use. If so, cancel it and go fee-free. Plus if you only did it because the bank said you should, try our free reclaim packaged bank fees tool.

However if you need the insurance, packaged accounts can be great. For £10/mth the Nationwide FlexPlus* gives world family travel insurance, smartphone insurance for all the family at home and European breakdown cover. A family needing them all could pay £600/yr separately. See Top Packaged Accounts for more options. | | | | 10. | Barclays customer? Get a free £48/yr. It's bottom for service and not great on rate, but if you want to stick, get a free £48/yr from Barclays. | | |

Frequently asked bank account questions Q. Can I still reclaim bank charges for going beyond my overdraft limit? Yes, if it has contributed to financial hardship - see Bank Charges Reclaiming. Q. Which pays more - free cash or bank savings interest? As a rough rule of thumb, if you've £10,000+, Santander 123* wins. Below that, it's close and gets a little nerdy; read my full free cash vs bank savings analysis.

Q. I hate banks - can I get an account elsewhere? Nationwide* is a building society not a bank. Or for a total change, try a Credit Union (local savings and loan non-profits), though not all offer current accounts - check yours. Q. I can't get a bank account, what can I do? Sadly, more than one million people in the UK don't have a bank account. Yet as long as you've ID, you should be able to get an account, but you need to ask the right way. See our full Basic Bank Accounts guide for step-by-step help. | | | | | | | | | | | | | | | | | | Martin's brand-new 58+ page printed booklets for 2016. All you need to know about cutting mortgage costs

Lenders are still touting eye-poppingly low mortgage rates as UK interest rates show little sign of rising soon. So EVERYONE with a mortgage should be checking their deal, and for first timers it's a great time to get a mortgage (though that's not quite the same as saying it's a great time to buy a home). To help we've brand-new free booklets. -

First Time Buyers' booklet 2016. If you're looking to buy, or even just at the 'should I be thinking about it?' stage, this 58-page guide aims to take you through it step-by-step. It includes info on the new Help to Buy ISA, what deposit you need, and of course how to pick the perfect deal. First Time Buyers' booklet 2016. If you're looking to buy, or even just at the 'should I be thinking about it?' stage, this 58-page guide aims to take you through it step-by-step. It includes info on the new Help to Buy ISA, what deposit you need, and of course how to pick the perfect deal.

Free First Time Buyers' Mortgage Guide 2016

Either download an instant PDF or order a printed booklet (it'll take 1-4 wks) People seem to rate it, @foodieclaire tweeted: "@martinslewis Thanks for your amazing free MSE mortgage guide. So easy to digest as a forthcoming first-time buyer", and @KatieGormanx: "Just read @MoneySavingExp First Time Buyers' Mortgage Guide from start to end. Martin Lewis knows his stuff". -

Remortgage booklet 2016. If you have a mortgage, this 68-page booklet shows step-by-step how you can get a better deal. Many can cut their annual costs by £1,000s. It takes you through analysing your current deal and finding a new one, including the impact of 'affordability criteria' on remortgaging. Remortgage booklet 2016. If you have a mortgage, this 68-page booklet shows step-by-step how you can get a better deal. Many can cut their annual costs by £1,000s. It takes you through analysing your current deal and finding a new one, including the impact of 'affordability criteria' on remortgaging.

Free Remortgage Guide 2016

Either download an instant PDF or order a printed booklet (it'll take 1-4 wks) As Caroline said on Facebook: "Downloaded your remortgage guide before Christmas, and have managed to get a new deal saving us £3,000 over 2 years. Thank you Martin." | | | | | | | | | | | | | | | Then learn the art of EXTREME COUPONING with the MSE Coupon Kid who got '£105 of shopping for £1.62'

The coupon clipping craze is exploding. As more people get into it, more companies use coupons for marketing, thus creating a virtuous circle. Whether you're a beginner or pro, we've clipped the key info below... -

150 coupons worth £150+. Our updated Supermarket Coupons page now boasts more coupons than we've ever had before, including £1 off Laughing Cow cheese, £2 off Lenor and £1.75 off Aussie shampoo. It's an easy way to cut grocery costs. You can stop there, but if you want to take it up a level... 150 coupons worth £150+. Our updated Supermarket Coupons page now boasts more coupons than we've ever had before, including £1 off Laughing Cow cheese, £2 off Lenor and £1.75 off Aussie shampoo. It's an easy way to cut grocery costs. You can stop there, but if you want to take it up a level...

-

EXTREME Couponing - '£105 of shopping for £1.62'. This is a bit of MoneySaving nerdvana. With work and effort you can get jaw-dropping reductions. We've asked MSE's Coupon Kid, Jordon Cox (he of the 'cheaper to fly to Berlin than get the train' fame), to add his tips to our step-by-step Extreme Couponing guide to show you how he got a £105 shop for £1.62. Tips include...

- Decode coupon barcodes. You don't need a scanner, find how to read a barcode by sight.

- Get stacking. This is how to combine a range of offers on one purchase for a mega-saving - see how to stack.

- Write a poem (or just an email) to a manufacturer. Companies love hearing how much you enjoy their products and often send coupons to say thanks. Poems and drawings go down particularly well. See blag coupons.

- Cashback apps give freebies. You usually just need to upload a photo of your receipt. See cashback apps work.

- Do your homework. To go extreme takes work & knowledge, so spend time reading all 30 couponing tips. | | | | | | | | | They can get this email free every week | | | | | | | | | FREE £4-£10 Lancôme beauty sample. Get a free 5ml Advanced Genifique serum & 5ml moisturiser. Lancôme

Extra 40% off Hot Diamonds up to 50% sale code. MSE Blagged. Discount on its women's jewellery sale. Eg, silver necklace for £27 (was £90), silver earrings for £18 (were £60). Ends Wed 2 Mar. Hot Diamonds

John Lewis 'sale matching' Debenhams up to 25% off ALL DEPARTMENTS. Debenhams has up to 25% off (some depts 10%, eg, beauty) and John Lewis is matching an, ahem, "unnamed competitor's" sale. High st sales

£19 Nails Inc collection (norm £88ish indiv). MSE Blagged. 8 full-sized polishes & 700 avail. Nails Inc | | | | | Feel the need for speed - superfast up to 38Mb fibre broadband for less than the cost of most standard deals

The key to cheap broadband is to pounce on hot, short-lived promo deals. And here, factor in the money you get back and you pay less than £200/yr. Contrast that to Sky, TalkTalk and Virgin whose standard prices are c. £300-£400 and their standard fibre prices £400+ a year. Here's how it stacks up.

-

Ends Thu. BT fibre broadband & line rent. It's a year's contract for phone line rental and unlimited download, up-to-38Mb speed broadband. It's available to 75% of the UK (based on postcode), but sadly NOT existing BT broadband customers... Ends Thu. BT fibre broadband & line rent. It's a year's contract for phone line rental and unlimited download, up-to-38Mb speed broadband. It's available to 75% of the UK (based on postcode), but sadly NOT existing BT broadband customers...

1. Sign up. Go via this specific BT link* before 11.59pm Thu 25 Feb.

2. Pay line rent upfront if you can afford to. It's £194.28 for the year - if not it's £17.99 monthly. You choose which option during the application.

3. Unlimited fibre b'band's £10/mth during 1yr contract. Yet there's also a £49 activation fee, plus a 'free' BT Infinity Hub router, though you pay £7.95 p&p.

4. You need to CLAIM a £100 prepaid Mastercard. After installation fill in this online claim form and it's sent within 30 days, then spend on it like normal plastic. Do take a note of this link & diarise it. BT WON'T remind you.

5. MSE Blagged. You're AUTOMATICALLY sent a £75 cheque within 4mths. We've blagged this extra boon, but you must use the link above. If you've ad- or cookie-blocking software, turn it off or the deal mightn't track.

- What about calls? Weekend calls to UK landlines are included - see BT costs.

- No line/switching from cable? Not a problem as installation's free.

- Want BT Sport? BT Sport Lite's included - the full shebang is £3/mth or free with BT TV.

So all in, how much is this? It's £371.23 if you pay upfront for the year (before calls), but factor in the £75 cheque and that you claim the £100 Mastercard, and it's £196.23/yr, equivalent to £16.35/mth - a similar cost to many standard line-rent-ONLY deals. If you pay the line rent monthly it's £217.83 (before calls) equivalent to £18.15/mth. -

Don't need fibre? Not everyone needs superfast - see do you need fibre? If not the cheapest standard broadband is Sky's b'band & line £216/yr, plus a £100 M&S vch. For our full best-buys see Cheap Broadband. | | | | | | | | | | | | | Do generations young and old get a fair deal? A group of MPs is looking at whether government policies treat different generations fairly, in terms of housing, financial wealth, benefits and pensions - and what could be changed for the better. Tell us your views in the MSE Forum by Sunday and we'll pass them on. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 25 Feb - Good Morning Britain, ITV, Deals of the Week, 7.40am. Watch previous

Fri 26 Feb - This Morning, ITV, Martin's Quick Deals, from 10.30am. Watch previous

Mon 29 Feb - This Morning, ITV, Money Monday, from 10.30am. Watch previous

Mon 29 Feb - BBC Radio 5 Live, Lunch Money Martin, 12noon. Subscribe to podcast | | | | Thu 25 Feb - BBC Radio Manchester, 4.20pm

Tue 1 Mar - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: Could I save money if I paid off my mortgage on a weekly basis instead of a monthly one? Peter, by email. MSE Helen's A: If you could, the amount you'd save would be minimal. Taking this to its extreme, if you paid 1/30th of your mortgage payment each day, then you'd only save around 60p per month in interest (assuming a £150k mortgage, 25-year-term at 3% interest). Paying weekly would mean your saving would be even less. However, the main problem is, unless your mortgage is small, you're unlikely to find a way to do this. Almost all mortgage lenders set up contracts and direct debits where you repay them monthly. To direct debit you more frequently would be an administrative nightmare. You may be able to overpay your mortgage each week and ask for it to reduce the monthly payment next month instead of shortening the term, thus "paying weekly". But most lenders limit the amount you can overpay, or at least the amount you can overpay before the overpayment shortens your mortgage term rather than decreases your next month's payment. In short, it's a nice idea - but a lot of hassle for a very small gain. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week. However before we go take a look at this Are you prepared? discussion on our forum. Started in 2012, it’s had a staggering 37,400 responses and 2.7 million views. It’s all about being ready for anything from the corner shop running out of milk to a full-scale zombie attack - and of course all done on a budget. We hope you save some money,

Martin & the MSE team | | | | | | |