| New mobile friendly email: We've reworked the code & tweaked the design. Please feedback in the forum, tweet me or email us. Martin | | | | | The Top Tips in this email | | Menu links don't work in some email readers. If so, scroll, scroll, scroll... | | 1. Martin's Briefing 25 under-25s tips: free Microsoft Office, get paid to drink... | | 2. Flight delay victory: are you due £440? | | 3. Get PAID to shift debt to 32mths 0% | | 4. Decipher hidden discount codes on price tags - 13 shopping secrets | | 5. Santander 123 fee hike: should I ditch? | | 6. Argos 3for2 on ALL toys is back | | 7. Ends Sat: Check Amazon for 'free' £10 | | 8. Free £15ish Vision Express eye test | | 9. Free tix: Wedding Show, Cake & Bake | | 10. Two specs £19 | | 11. Are you in Leeds, Manc, Reading, or B'ham? Free Martin Lewis Roadshow | | 12. Quickies: free Coke, pint, Sky Sports | | 13. Hot home ins freebies, eg, Pure DAB radio, £80 M&S, £70 Amazon | | 14. Travelzoo 10% gets £22 beauty treatment | | | | | | | Martin's Weekly Briefing: For more tips, alerts & puns, follow Martin on Twitter - Make the most of student life, apprenticeships or a first job

- Free Microsoft Office, 50% off Spotify, £1.50 travel across the UK

- Get paid to drink sensibly, reclaim tax, make money online

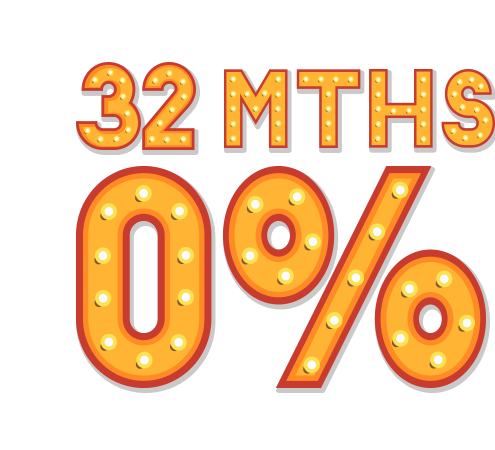

This is my equivalent of the Young Person's Railcard - it gives discounts to those 25 or under or students of any age. And with millions heading off to uni I want to give you tips that do the same (eg, for an extra year of YP Railcard discounts, diarise to get the day before your 26th birthday or get a 3yr card the day before your 24th).

Of course there's the thorny issue of tuition fees and student finance too, which doesn't work like most expect - see my updated 20 Student Loan Mythbusters. Yet if you're going to uni, are in training or work, you're likely past that - but not these... | 1. | Get paid to drink (yes, really). If you're 18 or 19 get up to £20 per outing to be a pub mystery shopper, but don't worry, it's responsible - you're checking if pubs, clubs and even bingo halls serve alcohol with no ID. Pls be Drinkaware. | | | | 2. | Free Microsoft Office software. If you've a student or uni email address you may be able to get it at no cost - see Free Microsoft Office.

Plus whether you're a student or not there's a host of other (legal) professional-standard software free from Free Antivirus to Free Office & Graphics Software. | | | | 3. |  Build a credit history. Credit scoring's about predicting future behaviour based on your past. If you've had no past credit this is a cause of rejection in itself. So, paradoxically, you need credit to get credit. Build a credit history. Credit scoring's about predicting future behaviour based on your past. If you've had no past credit this is a cause of rejection in itself. So, paradoxically, you need credit to get credit.

Please don't think I'm encouraging you to borrow. Credit scoring affects far more than debt - getting a mobile, cheap energy, car insurance. Plus the earlier you start, the better chance of getting a mortgage later. See our new 13 tips to build a credit history. | | | | 4. | Student bank accounts aren't all the same - get a free 4yr railcard or genuine £2,000 0% overdraft. Beware freshers' fairs where banks may have paid for 'exclusive access' to sell their services to you. Choosing the right account's crucial, eg, many advertise 'up to' amounts for 0% overdrafts which not everyone will get. Our Top Student Accounts 2015/16 takes you through it. | | | | 5. | Not a student? Switch bank accounts for a free £125. If you take home at least £750/mth you may be able to get an account that pays you to get it including Halifax's free £125 & £5/mth if you're in credit. For more see Top Bank Accounts to decide which is best for you. | | | | | 6. | Get £159 off a Mac if you're a student (or know one). This Apple trick bags students and teachers up to 15% off Macs, iPads and more. But parents or anyone who is friends with a student can get the discount. | | | | 7. | Watch TV and (legally) don't pay the licence fee. Find when you should pay and when you needn't in our 20+ TV Licence Tips. | | | | 8. | Students and council tax is complex. Students in all-student homes don't pay, but if you are sharing with non-students there is a charge. For how it works, what you're liable for and crucially how to split the bill, see Student Council Tax Discounts. Plus also our 54 Renting Tips guide. | | | | 9. | Renters can still switch energy and save £100s. Whether you're on a prepay meter or get a bill, switching energy (same gas, same elec, same safety, only price and who bills you changes) typically saves £240+/yr. So use our Cheap Energy Club comparison now to see if you overpay.

Can renters switch? Yes. The only thing you can't do without the landlord's permission is change your meter type (ie, prepay to billed meter). Yet some landlords don't know the rules so give them our Landlord's Energy Factsheet. | | | | 10. | Budgets are nonsense unless you know your income. Many parents preach the importance of budgets. While workers shouldn't spend more than they earn, no one says what students shouldn't spend more than.

So my rule is count your income as your student loan + any grant + any cash from parents + any work income and don't spend more. Note this doesn't include your 0% overdraft (that's for emergency cash flow only). To do a budget, use our Free Budget Planner. | | | | 11. | Travel UK-wide for £1.50. Find which routes let you bag a bargain £1 Megabus/Megatrain combo (50p fee) or if you want to let the train take the strain our Cheap Train Tickets guide incl the Tickety Split tool. | | | | 12. | Bag secret scholarships and hidden grants. Amazingly many of these student-only pots of gold go unclaimed each year. Our Scholarships and Hidden Grants guide has all the tricks in the school book in it. | | | | 13. | The 35 legit ways to make cash online. Sit in your digs in spare time and see what you can bring in, with our 35 Ways to Earn Cash Online. | | | | 14. | You can switch student accounts and gain, even once you start uni. Banks salivate over students, in the hope if they bag you, you'll stick with them for life. Yet in some cases you shouldn't even stay with them while a student - you're usually free to move. We say which offer existing students switch incentives in our Top Students Accounts guide. | | | | 15. | Winner, winner, yellow sticker - grab 75% off supermarket food. Supermarkets heavily reduce food as it's about to hit its sell-by date, even though it's still perfectly fine to eat. So with forumites' help we've a store-by-store yellow sticker times list to grab you max discounts. | | | | 16. | Furnish for FREE - TVs, toastie makers, saucepans & more. Some top-quality goodies are available daily for free from web communities such as Freegle & Freecycle. Forumite lofty_cherrytree says: "We received a free car, a breadmaker and a Kenwood Chef mixer." For full help to make the best of it see our how to use giveaway sites tips. | | | | 17. | Don't get home insurance without checking if your parents' policy covers you. You may already be covered under the 'temporarily removed from the home' section of their policy when in your student accommodation. Full info & options if not in Student Home Insurance. | | | | 18. | Amazon student discounts. If you've an academic email address, you can get a free 6mth Amazon Student trial, giving unlimited free next-day delivery - plus, if you've an NUS card, 5% off most Amazon products. | | | | 19. | You can earn £10,600 a year without tax - reclaim it if you've paid. Students are taxed like anyone else. In other words you have a personal allowance of £10,600 which you can earn before any income tax is taken. Yet if you've summer or temp work you'll be taxed as if you'd earn that rate all year. See how to reclaim tax and the income tax calculator. | | | | 20. | Get 50% off ad-free Spotify. Obviously the cheapest way is get it free and listen to the ads, but if you do pay, students can get 50% off Spotify Premium. | | | | | 21. | Ask for student discounts, even if they're not offered. Many bars, shops & restaurants scream student discounts you can't miss. Others are less obvious, so always ask - it's just a form of haggling. And while we're at it see 20+ High St Haggle Tips and Haggle with Sky, BT etc for more cost-cutting. | | | | 22. | Look for quirky jobs, eg, taking notes for others in lectures. MSE Megan F was employed by student services to take notes for someone with a broken arm. One of the MSE team, who shall remain nameless (OK, it's Two-headed Jane) even agreed to be experimented on for cash. See Quirky Campus Jobs. | | | | 23. | Declutter for extra cash - sell unwanted CDs, games, mobiles etc. One's trash is another's treasure. Many of your childhood items may be piled up at home - use 'em to bag extra cash. See 42 eBay Selling Tips. | | | | 24. | A YEAR'S 2for1 cinema by manipulating Meerkat Movies. The Meerkat Movies trick shows how to get a year's 2for1 pass for a few quid. Darcy tweeted: "Loving Meerkat Movies - £27 saved over three weeks." | | | | 25. | Free gym classes and passes. If you've trainers, pounding the pavements costs nothing. But if that's not your thing, there's no need to tie in to unbreakable contracts. See Cheap Gym Memberships. | | |

For more, see our 57 Student MoneySaving Tips and 40 Young People's MoneySaving Tips guides. | | | | | Saved cash? Shout it from the rooftops. If this email's ever helped you, please forward it to friends and suggest they get it via moneysavingexpert.com/tips. | | | | | | | | | The European Court confirms that if the delay is caused by a technical fault, you're still due the compensation

If your flight arrives 3hrs+ late or is cancelled, under EU reg 261/2004 you may be due to up to £440 per person. We've piloted 400,000+ through this with our templates & tools - full help in Flight Delay Compensation. Here's the latest... -

Flight delay compensation - the basics... Flight delay compensation - the basics...

- You can claim for delays now or dating back to 2009.

- You must've arrived 3hrs+ late (see how to check past delay lengths).

- All flights from EU airports count - or to EU airports, but only if it's an EU airline.

- Compensation's fixed, based solely on delay & journey length. See what am I due?

- It must be the airline's fault - eg, bad weather doesn't count. See what counts?

- Airlines may offer vouchers, but you're entitled to cash. How much?

- Is it fair to airlines? Arguably not, if your flight cost £10 and you get £440. See Martin's legal vs moral concerns.

-

Highest possible court confirms you CAN claim for technical faults. A European Court of Justice ruling has just confirmed airlines can't avoid paying out just because a delay was caused by problems such as component failure or wear and tear. If like many your claim was on hold or rejected by the airline for this, you can ask it to reopen/reassess. -

'I received £640 after a 19.5hr delay'. Daily, we get scores of success reports. Here's an example emailed by Angela: "Without your help we wouldn't have been able to claim compensation for a 19.5 hour delay from Antalya to Manchester. We were originally offered £30, but I used your template and received £640." -

Free online reclaiming tool. Our flight delay reclaiming tool (in collaboration with complaining site Resolver) lets you enter details and then auto-drafts the complaint, sends it, keeps track and escalates it to the regulator, the CAA, if necessary. | | | | | | | | | | | | One top card now pays cashback if you shift existing credit & store card debt. You could save £100s or £1,000s

A balance transfer's when you get a new card that repays debts on an old card(s) for you, so you owe it, but at far lower interest. For the last few years a price war's meant ever-longer 0%s, but now they're fighting to lower fees too... -

Shift debt to 32mths 0% and get paid. HSBC* lets accepted new cardholders shift debt to it, in the first 60 days, for 32mths 0% for a one-off 1.4% fee (min £5). Yet until 30 Sep, shift £100+ and it also pays £25 cashback. As the fee's £14 per £1,000, if you shift less than £1,785, the cashback's bigger than the fee. So clear the card before the 0% ends and you can save £100s in interest and make a little bit of profit. Shift debt to 32mths 0% and get paid. HSBC* lets accepted new cardholders shift debt to it, in the first 60 days, for 32mths 0% for a one-off 1.4% fee (min £5). Yet until 30 Sep, shift £100+ and it also pays £25 cashback. As the fee's £14 per £1,000, if you shift less than £1,785, the cashback's bigger than the fee. So clear the card before the 0% ends and you can save £100s in interest and make a little bit of profit.

Shifting more? The new Halifax 20mths 0%* & Tesco 19mths 0%* cards are NO-fee.

Don't just apply in hope, that hits your credit file - first find the odds of getting most top cards via our Eligibility Calc. TOP PICK 0% BALANCE TRANSFER DEALS

Pick the card with the lowest total fee - provided you're sure the 0% gives you long enough to clear your debt. | | Card | 0% deal (REP APR AFTER 0% ENDS) | One-off fee (cost per £1,000 SHIFTED) | | New. Halifax* - Longest no-fee 0% card | 20mth 0% (18.9%) (1) | NO FEE | | Tesco Bank* - Next longest no-fee 0% | 19mth 0% (20.6%) | NO FEE | | Halifax* - Longer 0%, very low fee option | 24mth 0% (18.9%) (1) | 0.8% (£8) | | Lloyds Bank* - long 0% with a low fee | 28mth 0% (18.9%) | 1% (£10) | | HSBC* - Long low fee + till 30 Sep £25 back (2) | 32mth 0% (18.9%) | 1.4% (£14) | | Virgin Money* - Longest 0% balance transfer | 37mth 0% (18.9%) | 2.79% (£28) | | 1) 'Up to' 0% deals, ie, some get a shorter 0%. 2) Transfer £100+. More info & options: Best Balance Transfers (APR Examples) |

-

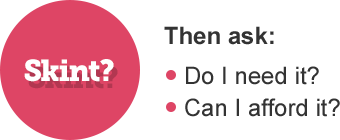

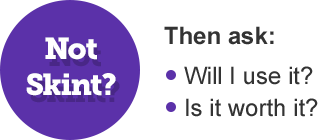

Balance Transfer Golden Rules. It's not just about picking the right card, it's about using it the right way...

a) Never miss the min monthly repayment or you can lose the 0% deal and it'll cost far more.

b) Clear the card or balance transfer again before the 0% ends, or the rate rockets to the rep APR.

c) Don't spend/withdraw cash on these. It usually isn't at the cheap rate & cash withdrawals hit your credit file.

d) Unsure what to pick? Use our Which Card Is Cheapest? tool. Full help & tips in Best Balance Transfers.

e) Members of cashback websites may be able to get more on top with some cards. | | | | | Two pairs of prescription specs £19 code. MSE Blagged. £36 off code works on 2for1 offer. Glasses Direct deals Come to The Martin Lewis Money Roadshow - Leeds, B'ham, Manc or Reading. Martin's about to start filming series 5 of his ITV show (it'll be on from Nov, Mon or Fri between the Coronation Streets). To ask him a question in person, or tell how much you've saved (or just to say hi), join a cashmob - see Martin Lewis Roadshow details.

QUICKIES: Free Coke Zero, free pint, 'free' Sky Sports day. Download free Coke Zero voucher to redeem in 60,000+ stores, plus 60,000 free pints of ale to use in 800 pubs. Also buy 2 Pringles to get a free Sky Sports day pass.

Hot home insurance 'freebies' - DAB radio, £80 M&S, £70 Amzn. MSE Blagged. Get cover via special freebies links (can take up to 120 days to arrive). 1) Combined buildings & contents: AgeUK* for a Pure DAB radio (RRP £80); PolicyExpert* or AgeUK* for an £80 M&S vch; or L&G* with code GIFT16 for a £70 Amazon vch. b) Contents or buildings ONLY. £25 Amazon* or M&S* vch via AgeUK. Warning: We're not saying these are cheapest - always compare with results after combining comparison sites.

2 large chilli plants £10 (next cheapest £35). MSE Blagged. With 40+ ready-to-eat chillies. 750 avail. Hot plant deals | | | | They can get this email free every week! | | | | | | | | | | | | | | | | | | | | | | Where can you get bargain food before closing, eg, sushi? Many know ‘yellow sticker’ supermarket reductions where they slash prices late in the day, but they're not the only ones - eg, Japanese takeaway Itsu slashes sushi and salad boxes by 50% 30 mins before closing (times vary by store). We want to tap MoneySavers' collective knowledge to find which do this and when's the right time. Share yours/read others': Food reductions Past topics: View all | | | | | How much data do you use on your home broadband? With streaming, downloads, software & gaming, many constantly eat data - yet how much do you use (if you’re not sure you can usually log into your account to see)?

Please give us your best estimate below for your home broadband data usage each month:

Last week: 24,470 voted on whether they agreed with the 5p charge for carrier bags. See full results for what they said. | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 24 Sept - GMB, ITV, Deals of the Week, 7.40am. Watch previous

Sun 27 Sept - Martin Lewis Money Show Roadshow, The Oracle, Reading, 11am-5pm

Mon 28 Sept - This Morning, ITV, Money Monday, 10.30am-12.30pm. Watch previous

Mon 28 Sept - Consumer Panel, BBC Radio 5, 12pm-1pm. Subscribe to podcast

| | Fri 25 Sept - BBC Radio Manchester, 4.50pm

| | | | | | | Q: I've a kidney problem and have been trying to find travel insurance. One application question is "have you ever been admitted to hospital as a result of a kidney infection?". I have but do I need to declare this as it makes a significant difference to the premium? Helen, by email. MSE Rebecca's A: Yes, you need to make sure your travel insurer is aware of your medical history and any health problems. If you don't give these details, or lie to the insurer, your policy may be invalid which will leave you having to pay any bill which could run into £100s or £1,000s - or worse, you could be prosecuted for fraud. Yet don't give up hope - there are some specialist insurers that may do it cheaper. See our Pre-Existing Conditions Travel Insurance guide for how to find hidden gems. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go, have a read of this from the forum: "Growing up, who did you have a crush on?" The answers really do show up the age of some of our forumites. Join the discussion and tell us about your teenage crush or idol.

We hope you save some money,

Martin & the MSE team | | | | | | |

No comments:

Post a Comment