| | | Martin's Weekly Briefing: For more tips, alerts & puns, follow Martin on Twitter - Test whether your credit history is good enough to turn lenders on

- Not just mortgages & loans; it's energy, mobiles & insurance too

- 35 tips to rouge up and make your credit file look better

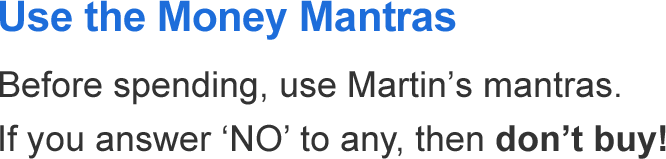

I'm writing this because I was shocked... at you, yes you, most of you should hang your heads. In our Jan poll, only 28% had checked their credit file in the last year, and 53% hadn't in 10yrs. This is potentially damaging to your finances - just one error in those files could kibosh them.

The impact of credit files has grown enormously; for mortgages, loans & cards, it's no longer just will you get 'em, but what rate will you get. And these days your file can affect your acceptance for energy, mobiles & car insurance too.

So managing your creditworthiness is crucial, but it's art not science. Just like going on the pull, different lenders like different things; but some things get most going. Full info in my 35 Credit Score Boosters, here are the BIG 5... | 1. | How attractive are you? Free test. You don't have a universal credit rating in the UK, each lender scores you differently. You may be surprised by this, especially if you've paid to see your 'credit score' (that's at best just a loose indication, missing crucial affordability data; do read my don't fall for the credit-score hype guide).

In the real world, what counts is whether you'll actually be accepted for products. While it's not what they're designed for, an easy way to test this is to take 1min to use our free eligibility calcs which show your % acceptance odds for lots of products. Do well, and you're tangibly attractive to lenders.

Eligibility Calculators for ...

0% Balance Transfers | Cheap Loans | Cashback Credit Cards | 0% Spending | Cheap Spending Abroad | Credit Rebuild Cards

These calculators' primary purpose is to let you home in on a top deal without hitting your file, eg, as Kelly emailed: "Legend. Used the balance transfer eligibility calc and got 35mths 0%, shifted £11,500 from up to 29.9% APR. I'm in shock thinking of the saving [£4,600 in interest]."

Will this affect my credit history? No. Unlike applying which leaves a mark, our eligibility calcs use a soft search so while you see it on your file, lenders don't. The same's true when you check your credit file. | | | | 2. | Check your credit file annually and before important applications. There are three main credit reference agencies: Experian, Equifax and Callcredit.

Best practice is check them ALL at least once a year; if not do the two big ones (Experian & Equifax). You've a legal right to check them for £2, but find how to check your files for FREE or even be paid up to £9.

Once you get it, check line-by-line for errors. If you don't, and there is a mistake, you may be rejected. And if you keep applying elsewhere after that, even once you fix the error, then having so many applications on your form could still mean rejection. So act sooner. | | | | 3. |  10 ways to rouge up your credit appeal. Here are the key cosmetic changes to make yourself more attractive to lenders. Full info in 35 credit boosting tips. 10 ways to rouge up your credit appeal. Here are the key cosmetic changes to make yourself more attractive to lenders. Full info in 35 credit boosting tips.

a) Get on the electoral roll. If not, getting credit's tougher, as it can cause ID and tracing issues. If you're worried about junk mail, just opt out of the 'open' register. See full electoral roll help.

b) Time it right. Applications stay on files a year, bad stuff (like defaults & CCJs) six years. So if they'll lapse soon, wait before applying. Plus avoid lots of applications in a short space of time.

c) Be accurate about your income. Lenders may verify this, and if it's wrong, you may be auto-declined.

d) Beware joint mortgages, loans & bank accounts. If your credit file is linked to someone else, lenders can see their history when you're assessed, so be careful if they've a bad history. Linking isn't about whether you snog or live together, it's simply from joint mortgages, loans, bank accounts and sometimes utility bills. Related: how to delink your finances.

e) Don't withdraw cash on credit cards. It's expensive & lenders see it as evidence of poor money management. See Is it different for special overseas cards?

f) Never miss or be late on repayments. Use a direct debit to be sure, even if just for the minimum (then you can repay more on top).

g) Check for address errors. Sounds trivial but isn't. An old, technically active but unused mobile registered to your old address, has been known to trigger a mortgage rejection.

h) Beware payday loans, they kill mortgage applications. Some mortgage underwriters simply won't lend to anyone who's had one. See our free First-Time Buyers' or Remortgage Booklets for more help.

i) Be consistent. Fraud scoring is credit scoring's secret cousin. If you've a couple of mobiles or job titles, use the same one every time you apply or it can be flagged up as odd. See fraud scoring info.

j) Get unfair defaults removed. If there's one on your file (eg, you didn't pay a catalogue loan as it failed to deliver the goods), get it removed or it can be a killer. For how see remove unfair defaults help, and even if it's fair, see how to mitigate the damage from defaults. | | | | 4. | To get credit, you need credit. Would you lend to someone you knew nowt about? How about someone who's not repaid others in the past? No, and nor will lenders.

Credit scoring predicts your future behaviour based on your past. So no credit history, or one that makes you look a bad credit citizen, usually means rejection.

The bizarre solution is to get a credit card, do £50-£100/mth of normal spending (never withdraw cash) & repay IN FULL each month to avoid interest. The safest way is via direct debit so you're never late. After 6mths to a year, you'll start to gain a history as a good credit citizen.

The catch-22 is how to get accepted if you've poor credit. The solution's specialist credit (re)build cards, and our eligibility calc shows which you're most likely to get. The two top picks are...

- Aqua Advance* which gives a £20 Amazon voucher after 2 months.

- Aqua Reward * which gives 0.5% cashback.

Both these are a horrid 34.9% rep APR if you don't repay in full, so make sure you do. If you can't get these, the last resort is the Credit Improver package, which costs £4/mth. | | | | 5. | What do they actually know about you? Lenders' info comes from three sources - and they plug in all of these to score you:

(i) Your application form tells them crucial 'affordability info' and more.

(ii) Any past dealings you've had with them. So a lender you've banked with has more info on you - sometimes good, sometimes not.

(iii) Your credit reference files, which include electoral roll info, products you have, court judgments & more.

As for whether they know if you've speeding points, a criminal record and more, see our full list of what they really know about you. | | |

PS: Are you due £100s back from Experian's CreditExpert? If you paid for Experian's £15/mth credit monitoring service from 2011 to 2014, you may have been unfairly sold part of it. Our Credit Expert Reclaiming guide shows how to get the cash back, as Dee did: "I sent Experian the template letter and received a payment of £243.59." | | | | | | | | | | | | | | | | | | If you think switching is too much hassle (it isn't but hey ho) just move to YOUR current provider's cheapest deal

We've nagged, begged, cajoled & arranged special tariffs, and 100,000s have switched and saved over £60 million this winter. Yet for those who've not checked if they're being ripped off, or refuse to switch (as many users report elderly parents especially tell them) this is our last-ditch trick... just change tariff with your same provider. -

BEST PRACTICE: Do a 5min comparison, save £100+, grab £30 cashback. A final nag: if you're one of the 70% on a standard tariff you're MASSIVELY overpaying. Do our 5min Cheap Energy Club Comparison; it'll find your cheapest, show what you can save, and give you £30 dual fuel cashback if we can switch you. -

IF YOU WON'T SWITCH. Find your provider's cheapest tariff. Bizarrely, even though it's the same gas, the same electricity, each energy firm charges a range of rates for using it. And no surprise Sherlock, it's the 'standard tariffs' that most people are on which are by far the most costly. They usually shift across at speed. | how much CAN you save without moving firm? | | Prices below based on dual fuel typical usage (1). Find YOUR cheapest via a quick comparison. | | Supplier | Supplier's standard tariff - which 70% of people are on | Supplier's cheapest tariff | | First Utility | £1,047/yr | £753/yr (saving £295) | | Npower | £1,110/yr | £765/yr (saving £345) | | Scottish Power | £1,070/yr | £806/yr (saving £265) | | Ovo Energy | £1,004/yr | £823/yr (saving £180) | | EDF | £1,100/yr | £825/yr (saving £275) | | SSE | £1,101/yr | £979/yr (saving £120) | | E.on | £1,047/yr | £1,015/yr (saving £30) | | British Gas | £1,075/yr | £1,044/yr (saving £30) | | (1) Ofgem defined. Assumes monthly direct debit, varies by region. 12,500 kWh gas and 3,100 kWh elec over a year. |

-

How to find YOUR SUPPLIER'S cheapest tariff. (It's also worth noting if your current deal has exit penalties most providers barring sometimes SSE, First Utility & Ovo don't charge for internal tariff changes.)

1) Go via Cheap Energy Club for £30 cashback. Use our comparison then scroll through results to find your supplier's EXACT cheapest. For many (not all) above, you can switch there and you get £30 dual fuel cashback.

2) Scan through our suppliers' cheapest tariffs list. We've compiled details of each supplier's cheapest tariffs though it is based on average usage and there can be regional variation. Then you can just call up and ask for it. | | | | | Ends Sun: 'Free' £7 Amazon code. Provided you haven't bought a gift card from it in the last 2yrs. Amazon £7

Are you married? Here's a free £212 - but hurry. If you're married or a civil partner, one of you pays basic 20% tax and the other's a non-taxpayer (ie, earns sub-£10,600), you're due a tax rebate. Go quick for this tax year. Claim £212

Mother's Day deals: free card, £3 flowers, restaurant deals, £18 Hugo Boss perfume. See Mother's Day.

Habitat 25% off almost everything 1day FLASH sale. Starts Wed 7pm. Online and in stores. Habitat sale

EXTRA 10% off discounted beyond best-before-date foods, eg, Loyd Grossman sauce 19p. MSE Blagged. 'Use-by' is a health warning, 'best before' just a manufacturer's optimum quality view. One online store specialises in selling at or near best-before goods at big discounts (min spend £17.50, deliv £5.99). We've a code... Approved Food | | | | | | | | | | | Named and shamed: House of Fraser, JD Sports, Karen Millen & more talk tosh on online returns

Unlike buying in-store, buy online and you have a legal right to change your mind and send goods back. New laws to give you more rights were introduced more than 20 months ago, but we've investigated online retailers' websites and found 13 that either haven't updated or are just wrong. Four more hide your rights behind their own usually less generous policies. -

Oi, House of Fraser, Karen Millen: you're talking tosh. A range of websites' return pages are giving out wrong info on your rights. See which are the worst offenders and let us know of any more. Here are examples of what's wrong. Oi, House of Fraser, Karen Millen: you're talking tosh. A range of websites' return pages are giving out wrong info on your rights. See which are the worst offenders and let us know of any more. Here are examples of what's wrong.

- Karen Millen says: "You've only 14 days from purchase to return an item", but the law is you've 14 days after it's delivered to cancel, then 14 days after cancellation to return.

- House of Fraser says: "Return an item within 14 days to get a refund via the original payment method", after that it's vouchers. This is POPPYCOCK. Again you've 14 days to cancel and 14 after that to return goods to get a full refund.

We've told these stores; Karen Millen hasn't replied (for 2 weeks) and while H of Fraser's made some changes it hasn't yet changed all parts of its site - we are reporting them & two others to Trading Standards. Thankfully after we contacted the other 13, they agreed to review their sites - we'll monitor to see how well it's done.

-

Tool up with your real consumer rights - so you can't be fobbed off. Online buying comes under the Consumer Contracts Regulations 2013, read our full know your rights guide or print our free wallet mini-guide. These are your legal rights. Firms can make them better, but they're not allowed to give you worse conditions.

1. Almost all goods bought online can be cancelled. The key exceptions are personalised and perishable goods.

2. You've up to 28 days after DELIVERY to return. You've 14 days to cancel & 14 days after that to return.

3. The refund is for the goods AND deliv charge. If you choose faster deliv you only get basic costs back.

4. You aren't entitled to costs of sending goods back. So if from another EU country, returning can be costly.

5. If goods are faulty you should get 'reasonable' costs of sending 'em back, under the Consumer Rights Act. | | | | | | | | | They can get this email free every week | | | | | | | | | | | | | Loan rates have hit rock bottom, but the Bank of England says they mightn't last long. If you NEED one, go quick

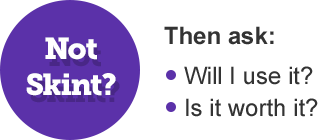

This week we've seen by far the cheapest-ever loan launch for £5,000 to £7,500 borrowing. Yet in Nov the Bank of England warned MPs that borrowing is worryingly 'picking up' and it may at some point effectively force personal loan & buy-to-let lending (not credit card) rates higher. So change could happen. Full help in Cheap Loans. -

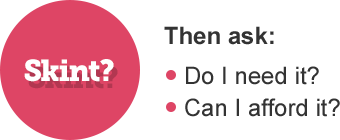

Ensure you can afford it. Debt's like fire; a good tool but get it wrong and you get burnt. Only borrow if a) you need it for planned spending, eg, car; b) you've budgeted and can afford repayments; c) you minimise it & repay as soon as you can. Ensure you can afford it. Debt's like fire; a good tool but get it wrong and you get burnt. Only borrow if a) you need it for planned spending, eg, car; b) you've budgeted and can afford repayments; c) you minimise it & repay as soon as you can.

-

UK's cheapest loans. All providers credit score you. Don't just apply in hope, it hits your credit file. First find your best acceptance odds via our Loans Eligibility Calc. - £7,500-£15k: HSBC's* 3.3% rep APR, as is Sainsbury's* over 1-3yrs with Nectar card.

- £5,000-£7,499: M&S* is the new lowest-ever at 3.5% rep APR, Sainsbury's* is next best at 4.2%/4.3% rep APR.

- £2,000-£4,999: Zopa's* 4.6%-7.9% rep APR, next is Hitachi* (min £2,500) at 7.4% rep APR for 2-5 yrs.

- £1,000-£1,999: Zopa* is 7.7%-7.9% rep APR, Hitachi* 12.3% rep APR for 2-5 yrs.

Sadly all these loans are 'representative rate', meaning ONLY 51% of accepted applicants need get that rate; the rest can pay more. Though very roughly the higher your eligibility calc odds the better chance of getting the rate. -

Nationwide customer? Trick to beat the cheapest. Apply and get accepted for a loan from any bank or building society (except peer-to-peer lenders incl Zopa), take acceptance proof to Nationwide and if you've your main current account with it (or you switch to it) it'll beat the interest by 0.5 of a percentage point. So a 3.5% loan becomes 3%. See Nationwide loan trick, incl its top current accounts to switch to and full eligibility criteria. -

0% credit card 'loans' are far cheaper for smaller amounts. Some 0% cards let new cardholders pay cash into their bank, like a loan, then you owe them instead - called a money transfer. Virgin Money* (eligibility calc) is 32mths 0% for a one-off 1.69% fee, Virgin Money* (eligibility calc) also offers 36mths 0% for a higher 2.39% fee. Never miss a repayment & clear the debt before the 0% ends or they jump to 20.9% rep APR. Do read FULL info in Credit Card Loans first though. | | | | | Free London Tube, train & bus travel on Mondays but... you need a Mastercard & Apple Pay. Till 14 March. TfL

Teachers/parents - how well is financial education taught in schools? It's now on the curriculum, Martin's giving evidence to MPs this month. He'd love YOUR input. Feed back in the forum or tweet him with #FinEd or email.

SUCCESS OF THE WEEK: (Send us yours on this or any topic)

"@martinslewis Currently in Brum in 4 star hotel for £45, advertised on hotel's own site for £95 #priceline #bid #whoop" For how to do it see Priceline bid loophole and uncover secret hotels.

MSE responds to proposed PPI time-bar consultation - 'it's a gross injustice'. Read why in our full response. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Thu 3 Mar - Good Morning Britain, ITV, Deals of the Week, 7.40am. Watch previous

Fri 4 Mar - This Morning, ITV, Martin's Quick Deals, from 10.30am. Watch previous

Mon 7 Mar - This Morning, ITV, Money Monday, from 10.30am. Watch previous

Mon 7 Mar - BBC Radio 5 Live, Lunch Money Martin, 12noon. Subscribe to podcast | | | | Wed 2 Mar - Share Radio, 11.20am

Thu 3 Mar - BBC Radio Manchester, 4.20pm

Tue 8 Mar - BBC Radio Cambridgeshire, 2.20pm | | | | | | | Q: I want to change bank accounts. Can I switch if I have a heavy overdraft since being a student, eg, £2,800? Leyla, via email. MSE Rosie's A: There aren't any set rules in place regarding switching bank accounts if you're overdrawn - whether you get an overdraft, and whether your limit is high enough to switch your existing one, will depend on the new account provider which'll credit check and decide if it's happy to accept you. This isn't to say that it's impossible - remember, banks make money from you being overdrawn so it can be in their interest to accept you. If you graduated in the last three years, it may be that a graduate account would be the best option for you as they tend to have good 0% overdraft deals. If your new bank or building society can't help, you'll need to make separate plans to pay back what you owe. For help on this, take a look at our Budget Planner, and for information on the best banks to switch to see Best Bank Accounts. Please suggest a question of the week (we can't reply to individual emails). | | | | | | | That's it for this week, but before we go, check out this thread from the forum: "What age were you when you spawned your first wrinkle?" Our forumites are full of wisdom but it comes with downsides. When did you get your first line? Or maybe a grey hair showed up first? Tips for a line-free face include sun dodging, plenty of moisturising - or adopting a relaxed pose. We hope you save some money,

Martin & the MSE team | | | | | | |

Multi Month Loans

ReplyDeleteWe’re a fully regulated and authorised credit broker and only work with direct lenders. We have information to help you choose the best long and short term unsecured personal loans with low monthly repayments.https://multimonthloans.co.uk/payday-loans/